what is the salt deduction repeal

Restoring the full SALT deduction would cost the US. This Bill Could Give You a 60000 Tax Deduction.

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

A new bill seeks to repeal the 10000 cap on state and local tax deductions.

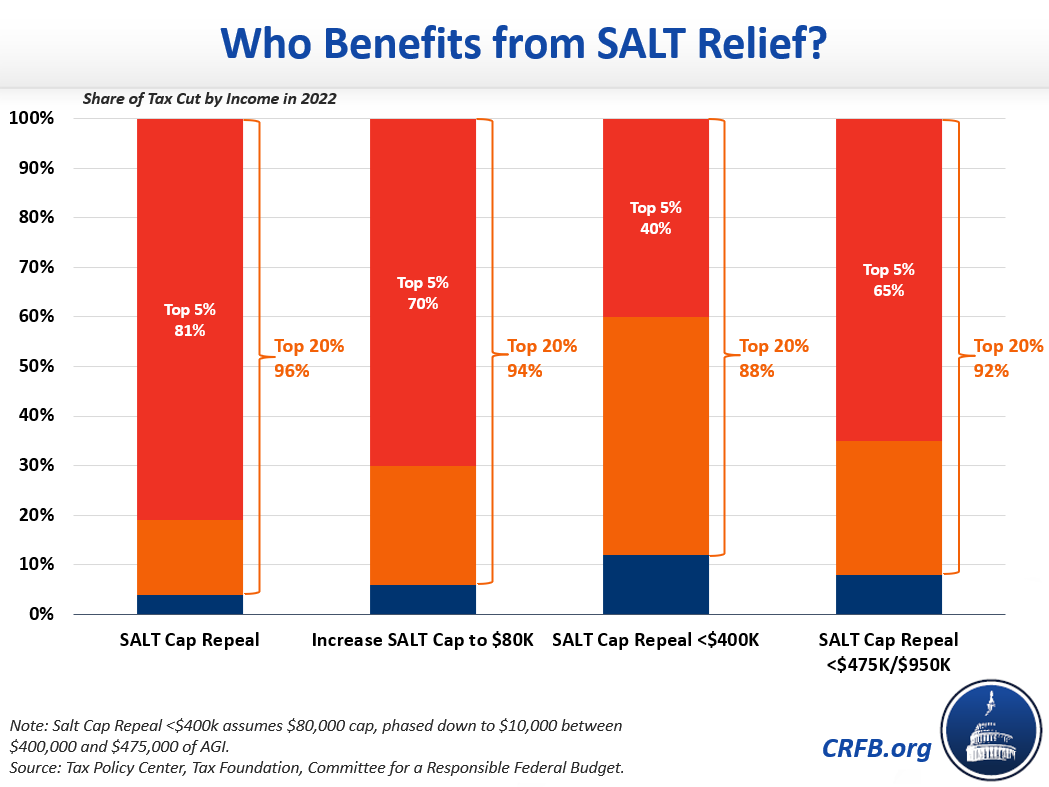

. The SALT deduction when no cap is in place is a highly regressive tax policy meaning its benefits go to the wealthiest taxpayers who regularly write off over 10000 on their taxes. 54 rows In 2018 only 321 percent of those filers itemized. New limits for SALT tax write off.

11 rows The TCJA also repealed the Pease limitation for tax years 2018 through 2025. Nov 19 2021. Kim is an original cosponsor of the bipartisan SALT Deductibility Act which would fully repeal the cap on SALT deductions and is a founding member and co-chair of the bipartisan SALT Caucus with.

That should spell the end. The entity which is not subject to the SALT cap may claim a federal Section 164 business expense deduction and shareholders. As Democrats debate Build Back Better the plan may still include changes to the 10000 limit on the federal deduction for state and local taxes known as SALT despite reports the.

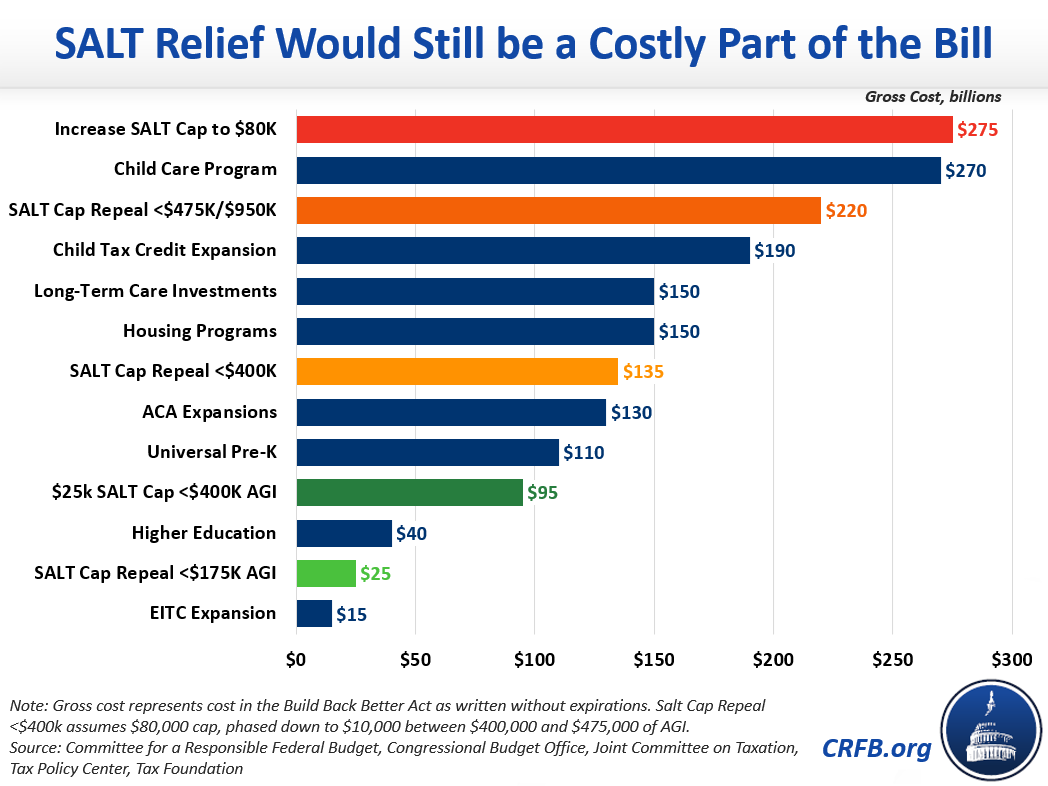

Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. 52 rows The state and local tax deduction commonly called the SALT deduction is a federal. Extrapolating beyond this data point indicates that state and local governments would cede significant revenue to.

For low- to moderate-income people the elimination of SALT deductions likely wont matter because both the House and Senate bills double the standard deduction from 6350 to 12000 for individuals and from 12700 to 24000 for couples. Unlike tax credits or public assistance programs tax deductions are inherently structured in a manner that disproportionately helps the wealthy. This would be in place of the House plan to lift the cap to 80000 through 2030 and reinstate it at 10000 for 2031.

According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less. Preserving the deduction cap or better yet a full repeal of the SALT deduction would result in wealthy residents feeling the full effect of the policies passed by their state and local governments. Americans who rely on the state and local tax SALT deduction at.

Bob Menendez D-New Jersey and Sen. House Democrats spending package raises the SALT deduction limit to 80000 through 2030. Bernie Sanders I-Vermont are proposing to keep the 10000 cap but only for higher-earning households somewhere.

The so-called SALT deduction cap which is poised to sunset in 2026 limits the amount of state and local taxes that Americans can deduct from their federal taxes to 10000. According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to their Build Back Better reconciliation package including one retroactive yearAs weve shown before this policy is highly regressive and would turn Build Back Better into a net tax cut for the vast majority of. Pass-through business owners in a growing number of states may take advantage of entity-level state tax elections as a measure of relief from the 10000 federal deduction limit for state and local taxes the SALT cap which was introduced under the 2017 Tax Cuts and Jobs Act or TCJA.

The change may be significant for filers who itemize deductions in high-tax states and. Without SALT there would be a race to the bottom in terms of state tax rates and. This significantly increases the boundary that put a cap on the SALT deduction at 10000 with the Tax Cuts and Jobs Act of 2017.

The expansion of the standard deduction. As far as the SALT deduction goes Sen. Treasury 887 billion in lost revenue for 2021 alone according to the Joint Committee on.

The SALT deduction allows states the fiscal room to spend. The SALT deduction allows states and localities to give their high income earners a discount on their taxes. Democrats are considering including in their social spending package a five-year repeal of the cap on the state and local tax SALT deduction sources told.

A group of moderate lawmakers are pushing to repeal the so-called SALT deduction cap in the reconciliation package saying no SALT no deal but other Democrats are trying to slam the brakes on. It allows those with the most expensive mortgages and by extension the highest incomes to deduct the most reducing their federal taxes by much more than those of the average. Though there is a controversy behind this change as the average SALT tax paid isnt even one-tenth.

Prior to the 10000 cap New Yorkers claimed an average SALT deduction of 23804. Finally the TCJA also. The trend among states to adopt elective pass-through entity taxes or PTETs.

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Why Repealing The State And Local Tax Deduction Is So Hard

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

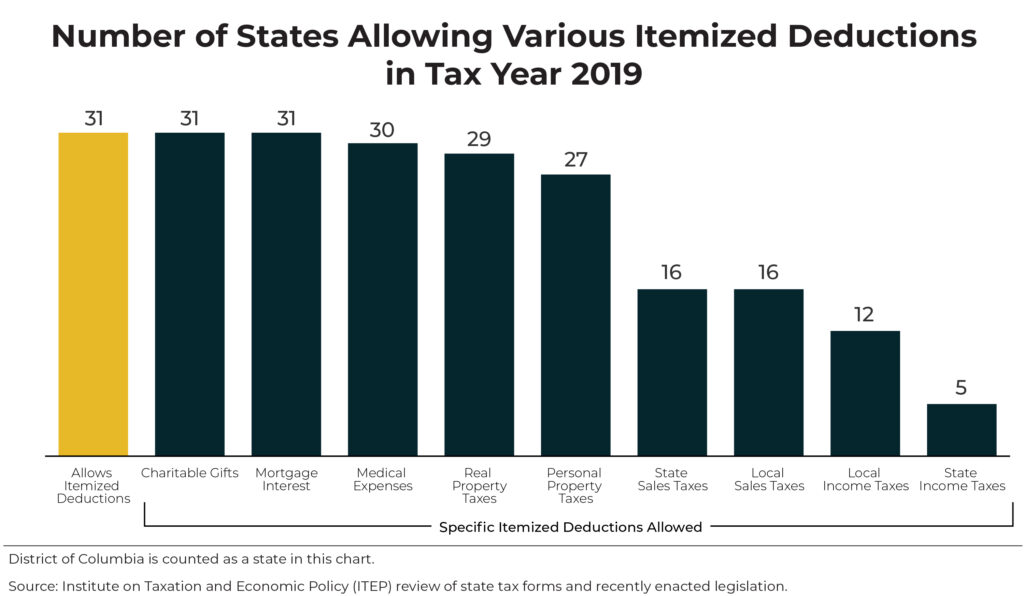

States Can Make Their Tax Systems Less Regressive By Reforming Or Repealing Itemized Deductions Itep

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Biden Officials Push For Progress On Infrastructure Plan By Memorial Day Youtube Memorial Day Progress Memories